There was a time when I could keep track of all the engineering software companies. We had a few big CAD and CAE vendors, a handful of smaller companies defying VC pressure, and a CAM company for every manufacturing market. 3D printers were things that our resellers lugged around but didn’t really work. Life was simple. I could keep it all in my head.

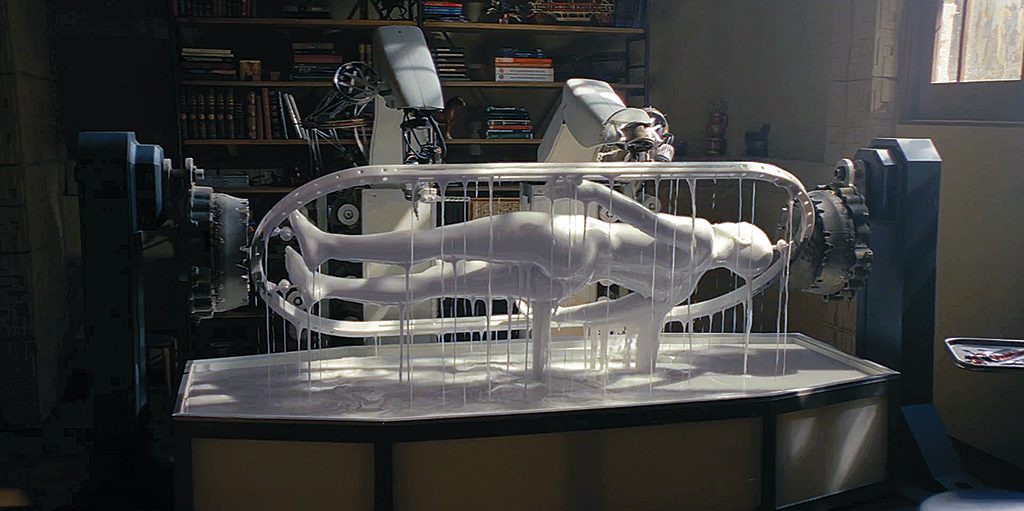

About a decade ago, 3D printing flooded our industry with post-2008 capital. STEM experiments evolved into our workforce, and “maker” culture became more popular than even SolidWorks. For the first time, consumer trends and mainstream software companies began to emulate our tech, and we all had to deal with triangle meshes. We made some of the 3D printers work, but the ethos of engineering evolved into a sci-fi future where autonomously generated designs are fabricated in Westworld slurries via robots murmuring in unlit, underground facilities. We all know what happened to Westworld.

Westworld’s trunnion of the future

While we gazed at our topology and field-optimized lattice parts, still sticky in our hands, and exclaimed that our “generative” and “computational” future had arrived, another industry was lurking. The same people who rendered our pretty pictures somehow started doing actual engineering on blockchain mining hardware. The next thing we knew, ML tech and AI solutions replaced out notion of “generative” with something more diffusive. And how did they do it? With the tricks of our trade: curve fitting, now rebranded as “surrogate modeling”, with MDO on steroids to interpolate massive parameter sweeps of the data.

It appears that when you take the nvidia Modulus training course, they now bundle in a Delaware C corp kit in partnership with Y Combinator. There are a few dozen startups using physics-powered neural nets on fluid dynamics problems, forever freeing CFD from the concept of Reynolds number until you want to validate your results with “empirical” data from OpenFoam. Will 1000x faster solve times grow the market for CFD and perhaps CAE in general?

Dare we try to ask our incumbent friends, we may have difficulty finding them. A decade or so of consolidation has made it impossible to know what web site maps to what product. Our sleepy little industry is seeing attention from the downright comatose EDA market. How to keep track of it all?

It started with the startups

In the fall of ‘23, Alex Huckstepp reached out to me with half dozen or so AI and ML engineering software companies he was talking to and asked me for a take. I didn’t know much about them, but had a similar list of friends, so I added it to his spreadsheet. Then I met up with Andy Fine, who was digging into the CFD side of things. Brad Rotherberg from nTop was working on his own list, and Luke Church, my partner at Gradient Control Laboratories, added some of the AEC startups he knew. After Alex and Andy posted some slides with some of the initial names, we learned that everybody likes being part of slides with lots of names. I tend not to be part of clubs that would have me as a member, but with feedback form LinkedIn, we adding everybody plausibly “generative”, doubling the list to about 50. It an attempt to prevent Alex from converting to paid on LogoIntern, I decided to interpret the data, trying to recall why I vowed never to use d3.js again. (TLDR: it make Javascript read like PERL.)

Data science professionals might tell you that interactive data bubbles, or even the idea of using bubbles to represent data, is “chartjunk”, but we’re going for entertainment value. So enjoy a little play with our industry at the da Vinci of data’s expense while you contemplate the quality of this data. At the moment of publication, many of the 200+ entries are incomplete. I’m sure there are tons of omissions or problems, but the data is live. Feel free to post a correction.

Methodology

While this chart is not data science, it is data driven. Here’s the basic idea behind the process:

Each company or technology receives a vector of industries, including: MCAD, CAE, CFD, CAM/MES, EDA, AEC, and IM/PM, and qualities, including AI/ML, Generative,PDM/PLM, VnV/SCM, Hardware, and Ecosystem/Community. (See tooltips to expand acronyms.) Also vendors of components of B_rep, Implicit, and Physics kernels are scored. All of these tags get a:

1if they are building that product or entering that space.2if they are established in that space.Nameif they are recognizable or referenceable brands, which count as2each.

In addition, there’s a list of components, critical technologies like Parasolid, CUDA, or Nastran on which a product might depend as well as partnerships that are valuable but easier to change, including interop toolkits.

From this data we generate the following display data dimensions:

- Each industry is assigned a hue, and each vendor’s scoring comes from a weighted average of its industry score fitness vector. Hue corresponds to the appropriate place in a horseshoe model where nano-scale IC fabrication meets the industrial manufacturing required to achieve it.

- The size of each circle represents the funding stage of the company plus its combined weighed score.

- All of the qualities and components are assigned two scores for

moatanddank, which get dotted with the fitness vectors.- The moat score represents how hard a company’s technology would be to reproduce, displayed as border width.

- The dankness refers to the trendiness of the tech market, displayed by a darker color. The OG name for this project was the “dank tech landscape”, but it didn’t Google well. Hardware emits negative dankness.

- And then there’s metadata for founding date, the headquarters location, and a URL.

What’s next?

I have no idea how enduring this project will be. Will probably add a legend for the info above and some more controls for controlling forces. Thanks to Mariana Marasoiu from Gradient Control Laboratories for suggesting vertlet over a T-SNE embedding and to Michael from Intact.Solutions, who requested the Disrupt button.

Would appreciate your feedback and would be happy to include any company that produces some sort of engineering software. For now, please enjoy, and happy April 1!